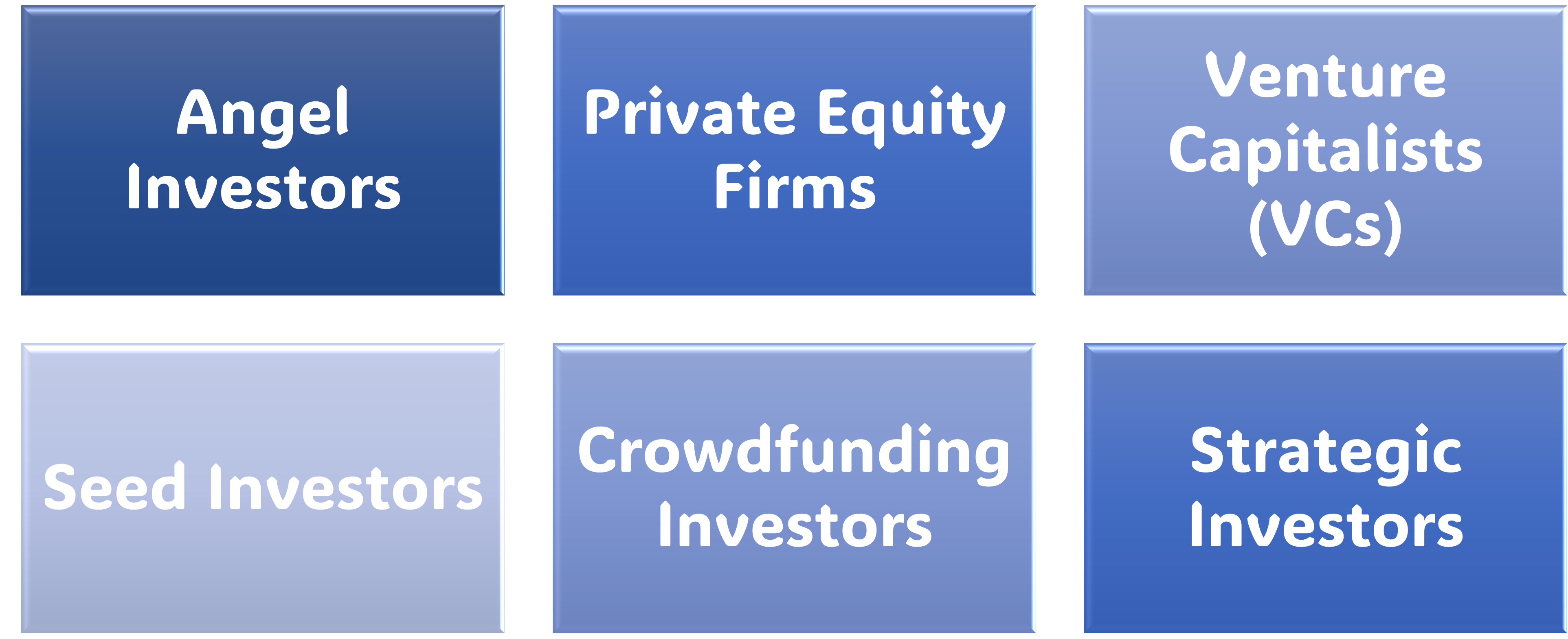

Various kinds of investors, including venture capitalists (VCs), angel investors, and seed investors, each have unique responsibilities, objectives, and anticipations when it comes to putting money into startups, especially those in the SaaS sector. Let's delve into these distinctions:

Angel Investors:

- Role: Angel investors are often individuals who provide capital for startups in exchange for ownership equity or convertible debt. They are typically entrepreneurs or business professionals with experience in the industry.

- Intentions: Angel investors often invest during the seed stage when a startup is in its early phase. Their intention is to support and mentor the founders, leveraging their own experience and industry connections to help the startup succeed.

Seed Investors:

- Role: Seed investors contribute capital during the initial stages of a startup's development, typically in the seed round. They may include individual angel investors, early-stage VC funds, or even friends and family.

- Intentions: Seed investors aim to provide the necessary funds for the startup to develop its minimum viable product (MVP) and validate its concept. They play a critical role in helping the company move from the idea stage to a more tangible and market-tested product.

Venture Capitalists (VCs):

- Role: VCs are professional investment firms that manage pooled funds from various sources, including institutional investors, pension funds, and high-net-worth individuals. VCs invest in startups in exchange for equity.

- Intentions: VCs typically get involved during the Series A, B, and later funding rounds. Their primary goal is to achieve substantial returns on their investment. VCs bring not only capital but also strategic guidance, industry expertise, and extensive networks to help the startup scale rapidly.

Private Equity Firms:

- Role: Private equity firms invest in more mature companies, often beyond the early-stage startup phase. They acquire a significant ownership stake in companies and may have a more hands-on approach to management.

- Intentions: Private equity investors focus on improving operational efficiency, enhancing profitability, and preparing the company for an exit, which could involve a sale to another company or an IPO.

Strategic Investors:

- Role: Strategic investors are often corporations or businesses that invest in startups for reasons beyond financial return. Their investment is strategic, aiming to gain access to new technologies, markets, or synergies with the startup's operations.

- Intentions: Strategic investors may seek partnerships, collaborations, or acquisitions down the line. Their involvement goes beyond funding, as they aim to align the startup's capabilities with their own business objectives.

Crowdfunding Investors:

- Role: Crowdfunding investors are individuals who contribute small amounts of capital, often through online platforms, to fund a startup. They may receive rewards, equity, or debt in return.

- Intentions: Crowdfunding investors are diverse and may have varying intentions. Some may be driven by a desire to support innovative projects, while others may be motivated by the potential for financial returns.

It is essential for entrepreneurs looking for funding to grasp the differences between these investor types, as it enables them to manage expectations and goals effectively at each stage of their startup's development. Each type of investor offers distinct perspectives, resources, and degrees of engagement, making it crucial to understand these distinctions.

Although the mentioned categories encompass the main types of investors, it's important to acknowledge that the startup and SaaS funding landscape is constantly evolving, and new investment models may arise in the future. Furthermore, within these broad categories, there may exist subcategories and specialized investors. Here are a few more factors and intricacies to consider:

- Family Offices:

Family offices are entities that manage the wealth and investments of affluent families. Some family offices actively engage in venture capital investments, providing capital and strategic advice to startups.

- Government Grants and Programs:

In certain regions, government agencies offer grants, subsidies, or incentive programs to support innovation and entrepreneurship. Startups can access non-dilutive funding through these programs, which can be especially relevant in the early stages.

- Corporate Venture Capital (CVC):

Some large corporations establish their own venture capital arms, known as corporate venture capital (CVC). These entities invest in startups strategically aligned with the corporation's business interests, aiming to gain a competitive edge through innovation and collaboration.

- Accelerators and Incubators:

Accelerators and incubators provide startups with not only funding but also mentorship, workspace, and resources. Startups accepted into these programs go through a structured curriculum to accelerate their growth and development.

- Convertible Notes and SAFE (Simple Agreement for Future Equity):

These are financial instruments commonly used in early-stage funding. Convertible notes and SAFEs allow investors to provide funding in exchange for the promise of future equity when the startup raises a subsequent funding round.

- Secondary Markets:

Secondary markets involve the buying and selling of existing shares in privately held companies. This allows early investors and employees to sell their shares before an IPO or acquisition, providing liquidity.

- Impact Investors:

Impact investors seek to generate positive social or environmental impact alongside financial returns. They may focus on startups that align with specific sustainability goals or contribute to social change.

- Cryptocurrency and Blockchain Investors:

With the rise of blockchain technology and cryptocurrencies, some investors specialize in funding startups in this space. Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) are examples of fundraising methods in the crypto space.

- Micro-VCs:

Micro-venture capital firms operate with smaller fund sizes compared to traditional VCs. They often focus on early-stage investments and may fill the gap between angel investors and larger VC funds.

- Bootstrapping:

While not an external investment source, bootstrapping involves funding a startup's growth through its own revenues without external funding. Some entrepreneurs prefer to maintain control and ownership by growing their companies organically.

Staying informed about emerging funding models and options is crucial for both entrepreneurs and investors. The investment landscape is rich with possibilities, and the ideal approach for a startup will depend on its specific needs, stage, and goals.